COMMODITY CFDS

Grow your portfolio by trading commodities

Trade commodities online including Gold, Brent Crude Oil and WTI Oil.

TRADE COMMODITIES WITH EQUITI

Trade on precious metals and energies from any device

Tight spreads

Leverage up to 1:2000

$3.5/lot per side commission

Precious Metals

Energies

Agriculture

ABOUT COMMODITIES

What are commodity CFDs?

Commodity CFDs are an efficient way to trade on the rising (or falling) prices of raw materials like gold, oil, natural gas and coffee – without owning the asset directly. This means you can trade on the price movements or performance of commodities without needing to own them outright – which allows you to go long or short and potentially benefit from either rising or falling markets. We offer both rolling and future contracts on our commodity CFDs.

LEARN WITH EQUITI

Forex FAQs

Forex (‘foreign exchange’ or ‘fx’) describes trading currencies in pairs, like EURUSD, on a decentralised over-the-counter global market. This allows traders to potentially profit from the increased (or decreased) value of a country’s currency in comparison to another. Each currency has an official abbreviation - in this case, EUR means ‘Euro’ & USD means ‘United States Dollar’.

When trading forex online, your base currency is shown first (here as EUR) and is followed by the quote currency (here as USD). The values of these currencies change quickly which is reflected in the spread, i.e. the difference between bid & ask price.

You can trade online on the performance of currency pairs by opening a single position on a secure trading platform.

A pip, short for ‘point in percentage’, is a very small measure of change in the value of a currency pair on the foreign exchange (forex) online market. It can be measured in terms of the quote or the underlying currency. It is a standardised unit for the smallest amount by which a currency quote can change, which is usually $0.0001 for USD-related currency pairs. A fractional pip or point is equivalent to 1/10 of a pip and there are 10 points to every 1 pip.

When trading forex, spreads with low pips (0.0 pip spreads) indicate that a product is traded very frequently but pips can also be used for risk management tools like Stop Loss orders.

Knowing your currency pair’s pip value allows you to manage your risk exposure, and potentially make the same profit across pairs. For example, if your Stop Loss equals 50 pips, the Take Profit could be 100-150 pips - as many think that having a SL/TP ratio of 1:2 or 1:3 is a good benchmark.

CFD trading, or "Contract for Differences" trading, allows you to open positions on the price performance of an asset without owning the asset directly. This means you have the flexibility to choose whether you think something's value will go up or down.

However, pure forex trading involves physically exchanging a currency pair for the value of another currency.

At Equiti, we offer FX CFD trading, which enables you to speculate on the price of a currency pair without directly owning it.

We offer leverage through the use of margins, where we provide borrowed funds from our deep liquidity pool to increase your trading position. This means traders can increase their market exposure by paying a fraction of their initial investment (their deposit).

In practice, 1:20 leverage means you can invest $10 and trade with $200 - allowing for higher potential gains AND losses. Make sure you understand your risk appetite. Try to minimise your losses by using Stop Loss tools or other risk management strategies - or experiment with leverage on our risk-free demo if you haven’t traded with it before.

We offer up to 1:2000 leverage on selected products including precious metals, gold, oil & natural gas commodity CFDs.

A rolling future is a contract that doesn’t expire, instead, at the date of the futures expiry (“rollover date”) - your positions are automatically rolled to the next contract month. Rolled over contracts result in an adjustment which will be added or subtracted to/from your cash balance (minus the spread).

This will appear on your statement as “{Symbol}futures rollover adjustment”.

Example:

Currently, EURUSDfuture is priced from the June futures contract.

The rollover date for EURUSDfuture is 14 June. On this day the contract price will roll from June to September (it’s a quarterly contract).

EOD prices on rollover date: EURUSD June futures = 1.11000

EURUSD September futures = 1.11720

At EOD (17h00 NY time) on 14 June the price of the EURUSDfuture will change from 1.11000 to 1.11720

Ahmed is long 10 lots of EURUSDfuture from 1.10500

Just before EOD on 14 June Ahmed’s position is showing a +$5,000 open profit (using the price of 1.11000 to mark to market).

At EOD (17h00 NY time) on 14 June the price of the EURUSDfuture will change from 1.11000 to 1.11720.

At EOD Ahmed’s position is showing a +$12,200 open profit (using the price of 1.11720 to mark to market). This is an additional +$7,200 of profit.

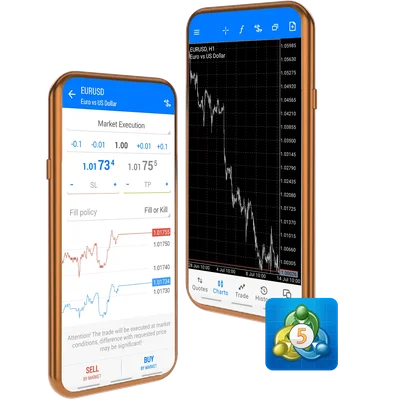

Platforms

Trade CFDs with live market data on MT5 from your phone or computer.

Trading accounts

Zero commission trading with low deposit requirements.

Partners

Introduce your client network for competitive benefits.