FINANCING FEES

Know our financing fees

Trade smarter by understanding how we calculate financing charges based on asset class, holiday & trading hours.

EQUITI SWAPS & ROLLOVERS

What are swaps & rollovers?

Trading markets take holidays too, be prepared for upcoming dates that may impact your open positions by causing extended rollover periods.

As we do not offer the physical delivery of assets, we adjust the price on some products for rolling the settlement day and allowing you to keep the position open. We recommend you always check the rollover fees (or “swaps”) per product to protect your trading strategy.

Please be aware that:

- When you trade forex of CFDs on a “spot” basis on MT5, most trades settle two business days (T+2 pairs) from inception – however some pairs (like USDCAD, USDRUB & USDTRY) are settled on a one business day basis (or ‘T+1’).

- Different asset classes settle on different days, our financing costs are calculated on a per position basis and that they may be charged to your account.

- Formula for forex & oil CFDs: Lots x Contract Size x Long/Short Swap x Point Size

- Formula for share & index CFDs: (Long/Short Swap)/360/100 x Closing Price x Lots

To learn more, check our FAQs page or see our holiday trading hours.

Download this quarter’s list of rollovers by product.

TRADE FOREX WITH EQUITI

We’ve packaged everything you need to trade forex online

Currency pairs

Spreads from 0.0 pips

Currency pairs

Low commission

Free research tools

Global support

ABOUT FX PAIRS

What are forex CFDs?

FX CFDs are contracts that are used to trade on currency pairs with added leverage. Online traders often choose CFDs as you can speculate on the rise or fall of an FX pair’s value – without directly owning it. “Forex” stands for “foreign exchange” (or currency pairs) and “CFDs” stands for “Contract for Differences”. Read more about these terms in our FAQs below.

LEARN WITH EQUITI

Forex FAQs

Forex (‘foreign exchange’ or ‘fx’) describes trading currencies in pairs, like EURUSD, on a decentralised over-the-counter global market. This allows traders to potentially profit from the increased (or decreased) value of a country’s currency in comparison to another. Each currency has an official abbreviation - in this case, EUR means ‘Euro’ & USD means ‘United States Dollar’.

When trading forex online, your base currency is shown first (here as EUR) and is followed by the quote currency (here as USD). The values of these currencies change quickly which is reflected in the spread, i.e. the difference between bid & ask price.

You can trade online on the performance of currency pairs by opening a single position on a secure trading platform.

A pip, short for ‘point in percentage’, is a very small measure of change in the value of a currency pair on the foreign exchange (forex) online market. It can be measured in terms of the quote or the underlying currency. It is a standardised unit for the smallest amount by which a currency quote can change, which is usually $0.0001 for USD-related currency pairs. A fractional pip or point is equivalent to 1/10 of a pip and there are 10 points to every 1 pip.

When trading forex, spreads with low pips (0.0 pip spreads) indicate that a product is traded very frequently but pips can also be used for risk management tools like Stop Loss orders.

Knowing your currency pair’s pip value allows you to manage your risk exposure, and potentially make the same profit across pairs. For example, if your Stop Loss equals 50 pips, the Take Profit could be 100-150 pips - as many think that having a SL/TP ratio of 1:2 or 1:3 is a good benchmark.

CFD trading, or "Contract for Differences" trading, allows you to open positions on the price performance of an asset without owning the asset directly. This means you have the flexibility to choose whether you think something's value will go up or down.

However, pure forex trading involves physically exchanging a currency pair for the value of another currency.

At Equiti, we offer FX CFD trading, which enables you to speculate on the price of a currency pair without directly owning it.

We offer leverage through the use of margins, where we provide borrowed funds from our deep liquidity pool to increase your trading position. This means traders can increase their market exposure by paying a fraction of their initial investment (their deposit).

In practice, 1:20 leverage means you can invest $10 and trade with $200 - allowing for higher potential gains AND losses. Make sure you understand your risk appetite. Try to minimise your losses by using Stop Loss tools or other risk management strategies - or experiment with leverage on our risk-free demo if you haven’t traded with it before.

We offer up to 1:2000 leverage on selected products including precious metals, gold, oil & natural gas commodity CFDs.

A rolling future is a contract that doesn’t expire, instead, at the date of the futures expiry (“rollover date”) - your positions are automatically rolled to the next contract month. Rolled over contracts result in an adjustment which will be added or subtracted to/from your cash balance (minus the spread).

This will appear on your statement as “{Symbol}futures rollover adjustment”.

Example:

Currently, EURUSDfuture is priced from the June futures contract.

The rollover date for EURUSDfuture is 14 June. On this day the contract price will roll from June to September (it’s a quarterly contract).

EOD prices on rollover date: EURUSD June futures = 1.11000

EURUSD September futures = 1.11720

At EOD (17h00 NY time) on 14 June the price of the EURUSDfuture will change from 1.11000 to 1.11720

Ahmed is long 10 lots of EURUSDfuture from 1.10500

Just before EOD on 14 June Ahmed’s position is showing a +$5,000 open profit (using the price of 1.11000 to mark to market).

At EOD (17h00 NY time) on 14 June the price of the EURUSDfuture will change from 1.11000 to 1.11720.

At EOD Ahmed’s position is showing a +$12,200 open profit (using the price of 1.11720 to mark to market). This is an additional +$7,200 of profit.

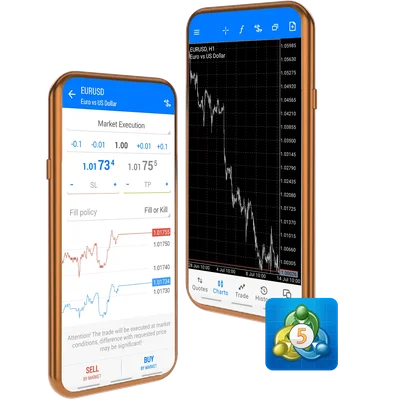

Platforms

Trade CFDs with live market data on MT5 from your phone or computer.

Trading accounts

Zero commission trading with low deposit requirements.

Partners

Introduce your client network for competitive benefits.